Introduction

Since 2011, electronic invoices (e-invoices) have been deemed equivalent to paper invoices for VAT purposes. The introduction of e-invoicing in Germany’s public administration was another important milestone in the digital transformation of administrative processes. Since late 2019, the federal administration has been required to accept and process e-invoices; and since 27 November 2020, all invoice issuers have been required to send e-invoices to their customers in the federal administration.

However, in practice there remains a lot of uncertainty with regard to e-invoicing. From a technical standpoint the term “e-invoice” is unclear: in everyday language the term is often used to refer to invoices in human-readable formats as well as to invoices in structured data formats. However, invoices in human-readable formats such as PDF files are not electronic invoices as defined in Directive 2014/55/EU.

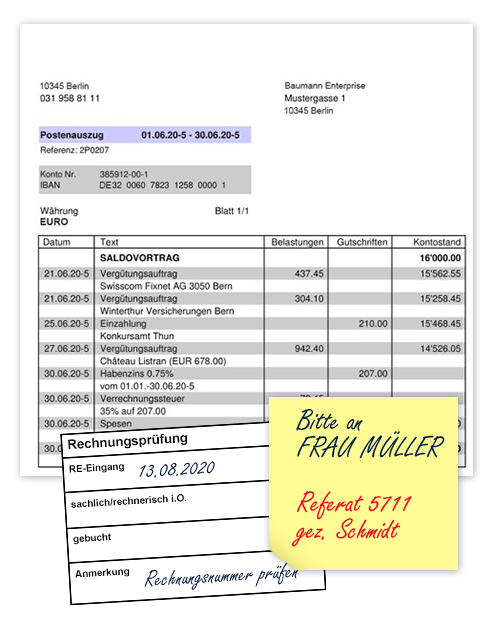

To demonstrate the differences between the various invoice formats, we will examine them here in detail.

Paper invoices

Paper is the traditional format for human-readable invoices. This format does not allow automated electronic processing. Digitising paper invoices (e.g. by scanning/photographing them) allows them to be processed electronically, but the information is still not available in a digitally structured format and must be entered by hand (or using additional systems) into the accounting software.

A paper invoice, then, is not an electronic invoice as defined in Directive 2014/55/EU.

PDF invoices

PDF invoices are created, sent and received electronically. However, their digital format does not allow automated electronic processing. PDF invoices present information in a human-readable format, like paper invoices in electronic form. For fully automated electronic processing, the invoice information contained in a PDF must still be entered into the accounting software, either by hand or using additional systems (e.g. text recognition systems such as OCR). The PDF invoice, then, is a typical example of a human-readable invoice. Other formats, such as .tif, .jpeg and .docx, are also suitable for a purely visual representation of invoice information.

However, none of the above formats can be used for electronic invoices as defined in Directive 2014/55/EU.

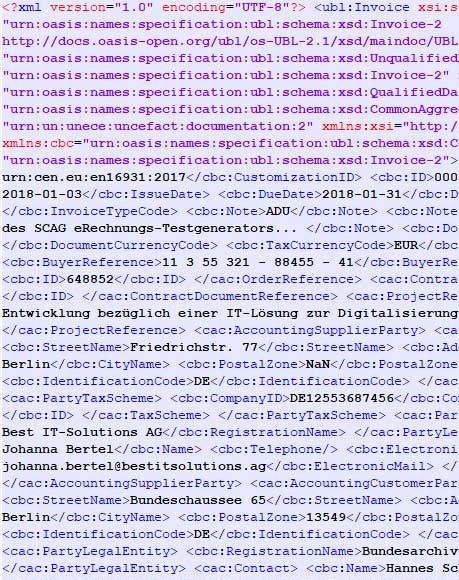

E-invoices

The key difference between an e-invoice and a scanned paper or PDF invoice is that an e-invoice (in line with the EU standard) is created in a specific structured format allowing it to be sent and received electronically and to undergo seamless automated electronic processing from start to finish. In contrast to a scanned paper or PDF invoice, an e-invoice

- is created in a purely semantic data format, enabling invoice data to be imported directly and seamlessly into the relevant processing systems;

- is based on an XML data format, which is primarily used for machine processing and is not designed to be visually readable. However, invoice data in this format can be made readable for humans with the help of XML viewer software.

The images below clearly show the visual difference between paper/PDF invoices and e-invoices. Whereas the paper/PDF invoice (left) displays data in a visual format that is easy for humans to read, an e-invoice (right) holds data in a structured, machine-readable data file.

Illustration: Example of a paper invoice

Illustration: Example of an electronic invoice

Electronic invoicing can be carried out using various standards and specifications, including the German XRechnung standard.

- The European standard for electronic invoicing (EN 16931) requires that the structured data format XML be used for exchanging electronic invoices. This format allows automated processing of invoices.

- So that each member state can implement the European standard in line with its own national requirements, each state defines its specific Core Invoice Usage Specification (CIUS).

- The XRechnung standard is Germany’s national version of the European standard (i.e. the German CIUS). It was created by the Coordination Office for IT Standards (KoSIT) on behalf of the German IT Planning Council.

- This standard was developed to meet the electronic invoicing needs of all public-sector contracting authorities. It is used for sending invoices to contracting authorities at Germany’s federal level and in most German states and municipalities.

- When submitting e-invoices to federal authorities, other standards may also be used (such as ZUGFeRD version 2.2.0 or later in the XRECHNUNG profile, as a simple structured XML file) provided they meet the requirements of the European standard EN 16931, the terms of use for the federal invoice submission portals, and the requirements of the federal E-Invoicing Ordinance (E-RechV).

An e-invoice in XRechnung standard is an electronic invoice as defined in Directive 2014/55/EU.

Paper-based processes are increasingly being replaced by digital processes. Invoice issuers and invoice recipients benefit from the lower costs, greater efficiency and transparency of e-invoicing.

If you have any questions about e-invoicing, you will find more information on this website, especially on the FAQ pages.