Important information: Please note that the federal invoice submission portals, ZRE and OZG-RE, will be consolidated by summer 2025. Following the consolidation, only the OZG-RE will be operated as the sole federal invoice submission portal. The operation of the ZRE will be discontinued as of 31 December 2025. Suppliers will receive all relevant information and the required details for future invoicing directly from the authorities to which they submit invoices. For further details, please refer to this article.

Consolidation of submission portals: Migration to the OZG-RE

How and to whom must the migration request be submitted?

The migration request must be sent to both ITZBund and Bundesdruckerei (to: support-erechnung@itzbund.de; CC: abruf-ozg@bdr.de). The request will be sent to the email addresses specified in the infrastructure questionnaire. Please ensure the information provided there is up-to-date and correct.

Is the migration of the buyer references performed manually or automatically?

The migration of the buyer references (Leitweg-IDs) is system-side and automated. The buyer references (Leitweg-IDs) stored in the test system are transferred to the productive environment and used there to retrieve invoices.

Will there be new credentials for the productive system?

Yes, there will be two separate accounts: one for the test system and one for the productive system. As soon as the migration request is received, the authorities will receive the access credentials for the productive system.

What should be done if the software used cannot be fully deployed by the deadline?

In such cases, it is recommended to contact the software provider and inform BeschA about the situation.

Can user information from ZRE (e.g. for specific Leitweg-IDs) be provided?

No, this is not possible for technical and data protection reasons.

What does the ZRE acceptance stop mean?

The acceptance stop means that ZRE no longer accepts invoices for migrated buyer references (Leitweg-IDs). However, invoices already submitted can still be retrieved.

Do suppliers need to be informed that invoices via Peppol are now sent to OZG-RE?

No, this is done centrally and automatically via Peppol. Suppliers do not notice the change – the redirection to OZG-RE happens system-side.

Do email addresses need to be stored on recipient side?

No, only the buyer references (Leitweg-IDs) are stored directly on the platform and can be managed there by the respective authority.

What about authorities whose testing phase has not yet started?

These authorities can potentially be included in the second wave. This requires a corresponding application and feedback to Bdr/ITZBund. Early activations using productive original buyer references (Leitweg-IDs) for testing purposes require prior bilateral coordination with the responsible bodies.

General information

What tasks does the OZG‑RE take on when transmitting e-invoices?

The OZG-RE assumes the following three tasks for the transmission of e-invoices:

- The receipt of e-invoices via various transmission channels.

- The technical verification of e-invoices (including invoice size, number and type of attachments, virus check, entry of all mandatory information)

- The transmission of e-invoices to the respective invoice recipient via buyer reference.

Which invoice receipt platform must be used for invoicing?

The following federal invoice receipt platforms must be used to submit electronic invoices:

- You can submit invoices to direct federal administration institutions and federal government constitutional bodies via the ZRE.

- You can submit invoices to institutions associated with the indirect federal administration, affiliated beneficiaries and cooperating federal states via the OZG-RE.

You will receive information on which invoice receipt platform to use via the underlying order or directly from the invoice recipient.

What are the differences between the OZG-RE and the ZRE?

The ZRE and the OZG-RE are functionally similar for invoice issuers and for invoice recipients. However, the group of affiliated invoice recipients is different.

The ZRE is the mandatory central invoice receipt platform for the institutions of the direct federal administration. The OZG-RE, on the other hand, is an optional service offered by the Federal Government; it forwards invoices to affiliated institutions of the indirect federal administration, affiliated beneficiaries and cooperating federal states.

Is there an overview of all OZG-RE invoice recipients?

Indirect federal administration institutions (and cooperating states) are connected to the OZG-RE. See the following page (in German only) for an overview of the public contracting authorities connected to the OZG-RE:

Can invoices be downloaded in XML or PDF format?

You can download all e-invoices, no matter how you submitted them, in XML format from the „Invoice status” page. The invoice in XML format is considered a valid original invoice.

What is “Mein Unternehmenskonto”?

The user account known as “Mein Unternehmenskonto” (which is based on the ELSTER tax software) provides companies in Germany with a central, standardised interface through which they can use the online administrative services of various authorities and communicate with those authorities. Further information on registering with and using “Mein Unternehmenskonto” can be found on the FAQ page of the “Mein Unternehmenskonto” website (German only).

What are the advantages in using the OZG-RE via “Mein Unternehmenskonto”?

“Mein Unternehmenskonto” provides companies in Germany with a standardised, single sign-on account through which to use not just the OZG-RE (for sending and receiving invoices) but other online federal administrative services as well. By using the OZG-RE via “Mein Unternehmenskonto”, invoice issuers and recipients can sign in more conveniently and benefit from a higher degree of security.

Registering to use the OZG-RE

How do I register to use the OZG-RE?

When registering with the OZG-RE, you create two accounts: a main account for your company (also known as the “OZG-RE account”) and a user account associated with that main account. Additional users may also be added to the main account. The user who carries out the registration automatically becomes the administrator of the main OZG-RE account. Registration should therefore only be done by a responsible member of the company.

There are two ways to register:

- You can register via the login page of the OZG-RE website. This will create an OZG-RE account. On the login page, click “Create new user account” to open the registration page. There you must enter the required information and confirm that you accept the terms of use. You will then receive an email containing a link. Click this link to activate the new account. This completes the registration process. If your company already has an OZG-RE account, contact the account administrator and ask them to add you as a user.

- You can register with “Mein Unternehmenskonto” (a user account based on the ELSTER tax software). This also gives you access to the OZG-RE. As part of the registration process you will be issued with an ELSTER organisation certificate. This is required in order to access the OZG-RE.

To register with “Mein Unternehmenskonto”, go to the login page of the OZG-RE website and click on “Register My Unternehmenskonto ”. Clicking this option will open ELSTER. Here you can switch the language to English and register for an ELSTER organisation certificate. Click “Next” and you will come to a page where you can enter your company information. Required fields are marked with an asterisk. Having entered all the required information and completed the registration process, you will receive your ELSTER organisation certificate, which allows you to sign into the OZG-RE.

To sign into the OZG-RE via “Mein Unternehmenskonto”, click on “Login with My Unternehmenskonto ”. Then enter in the field “Zertifikatsdatei ” the ELSTER organisation certificate (which you received when you registered) and enter your password in the field “Passwort” . Once you have confirmed that you agree with the forwarding of your personal data , you will be redirected to the OZG-RE.

Further information on registering with “Mein Unternehmenskonto” can be found on the FAQ page of the “Mein Unternehmenskonto” website (German only).

Is registration required for invoice senders to use OZG‑RE?

Yes! In order to be able to transmit invoices via OZG-RE, it is necessary to set up a company account.

Is registration or use of the OZG-RE for invoice issuers subject to a fee?

Both registration and use of OZG-RE are free of charge for invoice issuers.

Please note that costs may be incurred by the user while using the OZG-RE platform, in particular for the provision, connection and operation of necessary software and hardware as well as for Internet use, which will not be reimbursed by the responsible parties (publisher and technical service provider) of the OZG-RE.

What information do I need to provide to register for an OZG-RE account?

When registering for an OZG-RE account, you will need to provide at least the following information:

Company information:

- Company name

- Language

- Country

- VAT ID number

- Tax number

User information:

- First name

- Last name

- Language

- Email address

- Password

You will also need to accept the OZG-RE terms of use.

If your company already has an OZG-RE account, and the administrator just needs to add you as a new user, the following information is required:

- First name

- Last name

- Email address

If your company prefers to access the OZG-RE via “Mein Unternehmenskonto” (see the FAQ “How do I register to use the OZG-RE?”), the company information stored in “Mein Unternehmenskonto” (e.g. company address) will be automatically transferred to the OZG-RE. Since this method requires identification using an ELSTER certificate, your company information in the OZG-RE will be stored even more securely and accurately. There is also no need to enter your company information separately in the OZG-RE.

To register with “Mein Unternehmenskonto”, the following information is required:

Company information:

- Company name

- Country

- Tax number

Contact person:

- First name

- Last name

- Email address

User account details:

- Username

- Security question and answer

What should I do if I haven’t received an activation link after registering a new OZG-RE account?

If you haven’t received an activation link, first check the spam folder of your email account. If there is no activation link there, please contact the help desk of the Bundesdruckerei at sendersupport-xrechnung@bdr.de and request a new link.

What should I do if the activation link for my OZG-RE account has expired?

If your activation link has expired, please click on the expired activation link in your email. You will be redirected automatically to a web page where you can request a new activation link.

What should I do if I cannot request a new activation link for my OZG-RE account?

If you are unable to request a new activation link from the web page, please contact the help desk of the Bundesdruckerei at sendersupport-xrechnung@bdr.de to request a new link.

Submitting and receiving e-invoices via the OZG-RE

Which channels can invoice senders use to submit their e-invoices to the OZG-RE?

When using the platforms, there are five submission channels available to invoice senders for invoices:

- Web-based data entry

- Uploading

- Web service via Peppol

For more information about the submission channels, see the OZG-RE technical terms of use.

How does the web service transmission route via Peppol work through the OZG-RE?

As an additional transmission channel, the OZG-RE provides the option of sending invoices from the originating software through a web service and transmission via the Peppol network. The submission of e-invoices via Peppol is essentially possible in three different ways:

- Use of the web service via the Federal Government’s Peppol existing Access Point (free).

- Use of an existing Peppol service provider (chargeable).

- Fee-based membership with OpenPeppol and the establishment of your own Peppol Access Point

In principle, no registration with the OZG-RE is needed to transmit electronic invoices via the Peppol web service. However, the processing status of invoices submitted via the Peppolweb service can only be viewed if the “Web-based data entry and Peppol” transmission channel is enabled after successful registration and if the PeppolSender ID used by the sender has been entered.

How can I submit supporting documents and attachments of an e-invoice to the OZG-RE?

To submit supporting documents or attachments with your invoice, they must be embedded in the invoice data file and should not be sent separately as an email attachment. Documents of the following file types may be embedded: PDF documents (PDF), Images (PNG, JPEG, JPG), Excel spreadsheets (XLSX), Support and OpenDocument spreadsheets (ODS) and Text files (CSV) as well as XML when using an extension.

You have various options for embedding documents depending on the way you create your invoices and which transmission method you use to submit them to the Online Access Act-compliant Invoice Submission Portal (OZG-RE).

Create new invoice (via web submission)

If you create your electronic invoice manually (using the web submission form), you can manually add supporting documents of the accepted file types to the invoice. In the navigation bar at the top of the screen, click on “Additional documents”. This will open a page where you can select and upload the relevant documents from your computer, including via drag and drop. When you submit your invoice, the documents will be directly embedded in the invoice. Please note that the maximum number is limited to 200 documents.

Upload invoice file

You can submit your completed invoice in the XML format using the function “Upload invoice file”. To attach supporting documents, you must embed them in the XML file encoded in Base64 before uploading your invoice.

For more information, contact your software provider to ask about options for embedding documents in electronic invoices. Please note that the maximum number is limited to 200 documents.

Transmit via email

You can submit your completed invoice using email. To attach supporting documents, you must embed them in the XML file encoded in Base64 before submitting your invoice.

For more information, contact your software provider to ask about options for embedding documents in electronic invoices. Please note that the maximum number is limited to 200 documents.

Transmit via Peppol

You can submit your completed invoice using Peppol. To attach supporting documents up to 100 MB, you must embed them in the XML file encoded in Base64 before submitting your invoice.

For more information, contact your software provider to ask about options for embedding documents in electronic invoices. Please note that the maximum number is limited to 200 documents.

Can a previously submitted e-invoice be recalled?

No. Invoices submitted via the OZG-RE cannot be recalled.

Users can track the current status of their invoice in the log view. If you have submitted an incorrect invoice by mistake, please contact the invoice recipient.

Is invoicing via the OZG-RE possible at all times?

There are no time restrictions on the creation or submission of invoices via the OZG-RE. Maintenance work may result in a short period of unavailability at times however. Upcoming maintenance work will be announced in advance via a pop-up window.

Which software can be used to open e-invoices in XML format once they have been created in the OZG-RE and saved locally?

If the company does not have software for viewing locally saved invoices in XML format, a solution can be purchased on the market or developed in house. No solutions can be recommended here.

Is there a charge for receiving e-invoices via the OZG-RE for invoice recipients?

For each invoice provided via the OZG-RE, the invoice recipient must cover the cost. The amount of this payment is specified in the administrative agreement to be signed.

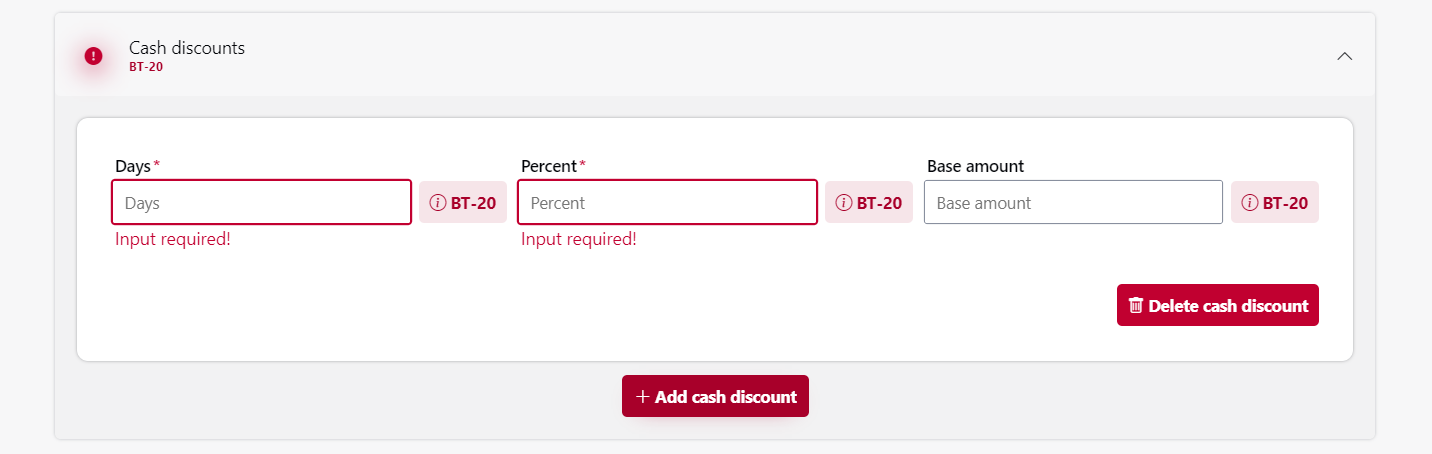

How can I include information about discounts in my electronic invoices?

When creating an electronic invoice (e-invoice), the invoice issuer has the option to give the invoice recipient a discount (reduced price) for early payment within a specified period of time.

Web submission:

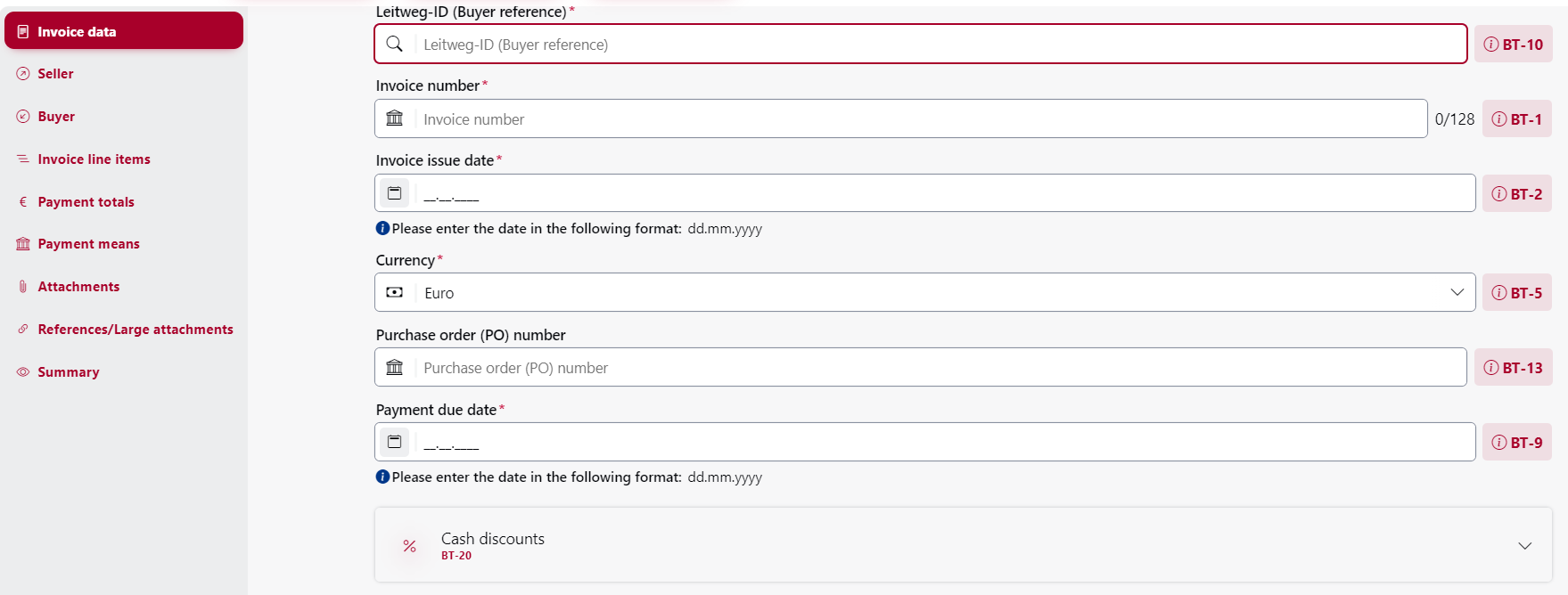

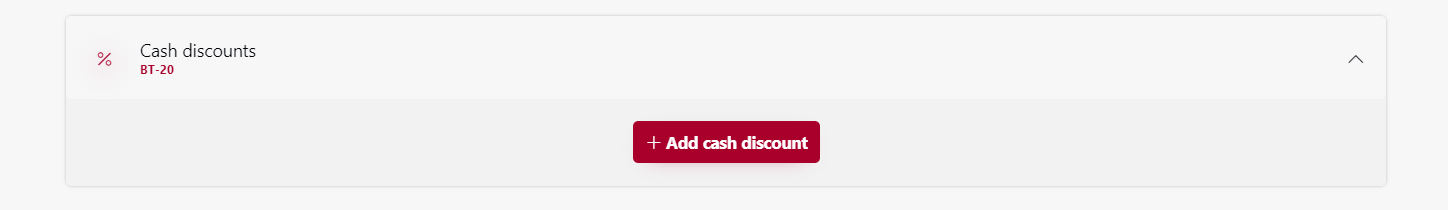

If you submit e-invoices using the web submission form on the OZG-RE invoice submission portal, under the tab “Invoice data” you can select the button “Add discount” to add terms for discounts to your invoice.

Example: Payment is due within 30 days. For payment received within 10 days (discount period), a 2% discount is given on the invoice amount due.

Illustration: Screenshot of the OZG-RE user interface for entering a new invoice

Illustration: Screenshot of the OZG-RE user interface for entering invoice data

Illustration: Screenshot of the OZG-RE user interface for cash discount information

Illustration: Screenshot of the OZG-RE user interface for specifying cash discount details

Upload:

Here you will find detailed instructions for including information about discounts when using the upload method for the OZG-RE:

![]() Download document discount upload

Download document discount upload

Email:

If you use email to transmit your invoice, your completed e-invoice (XML file) must meet the same requirements for information about discounts as described in the paragraph on using the upload method (see “Upload”).

Peppol:

If you use Peppol to transmit your invoice, your completed e-invoice (XML file) must meet the same requirements for information about discounts as described in the paragraph on using the upload transmission method (see “Upload”).

Status of e-invoices submitted via the OZG-RE

How can the status of an e‑invoice submitted via the OZG-RE be viewed?

You can track the status of the submitted invoice. To do so, select “View status of submitted invoices” in the Home section.

Depending on the processing status, an invoice can have the following status types: new, delivered, received and rejected.

In this section, you can also continue with a manual invoice entry previously started via web-based data entry.

What should I do if payment of an e-invoice submitted to the OZG-RE is still outstanding?

If payment of a submitted e-invoice is still outstanding after the due date, you should first check the status of that invoice in the OZG-RE. You can do this from the OZG-RE dashboard by clicking “View processing status of submitted invoices”.

We recommend that you only send an overdue payment reminder to the invoice recipient if the status of your submitted e-invoice is marked “Collected”.

If the status of your e-invoice is marked “Rejected”, please investigate possible reasons for this. There are two ways in which a submitted e-invoice can be rejected:

- Rejection by the OZG-RE: The submitted e-invoice is checked by the OZG-RE portal. If it does not meet the formal requirements of e-invoices or contains calculation errors, it is rejected by the portal.

- Rejection by the invoice recipient: In such cases, the submitted e-invoice is rejected by the recipient due to factual errors in the invoice itself. When rejecting an e-invoice, the invoice recipient should state a reason for the rejection. If no reason is stated, please check your submitted e-invoice and contact the invoice recipient if you are still unsure why it was rejected.

In both cases, the invoice must be corrected and resubmitted. However, please always check the status of your submitted e-invoice before taking any further steps.

The OZG-RE does not currently issue automated email notifications about changes to the status of your submitted e-invoices.

If you send your invoices via Peppol, you must register with the OZG-RE in order to view the status of submitted e-invoices. Registration and use of the ZRE are free of charge for invoice issuers.

How do I know whether the e-invoice I submitted to the OZG-RE has reached its intended recipient?

In the OZG-RE you can find the status of your submitted e-invoices under “Processing status of submitted XRechnung invoices ”.

The OZG-RE does not currently issue automated email notifications about changes to the status of your submitted e-invoices. A feature that would enable automated email notifications is currently being planned.

For further information on specific status notifications, please refer to the additional FAQs about the OZG-RE below.

What status notifications are issued for e-invoices submitted to the OZG-RE and what do they mean?

The OZG-RE has five different status notifications. They are:

- New: The invoice has been created in the web submission format but not yet sent. You have the option to continue processing.

- Provided: The invoice has been successfully transmitted and is awaiting collection by the recipient.

- Collected: The recipient has collected the invoice and confirmed receipt of the invoice.

- Rejected: The invoice has been rejected by the system or the recipient due to an error of form or content.

- Deleted: The last change in the status of the invoice was more than 28 days ago. The invoice was therefore deleted by the system.

Help with using the OZG-RE

How to change or reset a password for the OZG-RE user account?

Change password

After logging in, navigate to “Personal Settings” via the person icon. You can change your password in this section.

Reset password

You can reset your password using the “Forgot password?” function on the OZG-RE homepage by entering your email address. You will receive a link by email which you can use to specify a new password.

How can I change the email contact address in my user account for the OZG-RE?

The email address can only be changed by the appropriate administrator (in the user management section). Contact your administrator.

How can I (as the account administrator) make changes to the OZG-RE account?

First, sign directly into the OZG-RE, then select “Manage company account” from the dropdown menu at the top left of the screen. You can then edit your company information. To save your changes, click on “Update”.

If you have signed into the OZG-RE via “Mein Unternehmenskonto”, the company information you provided there (e.g. company address) will have been automatically transferred to the OZG-RE. If the company information has been transferred in this way, the “Mein Unternehmenskonto” logo will be displayed on the “Manage company account” page of the OZG-RE.

In this case, it will only be possible to edit your company information via the “Mein Unternehmenskonto” user account. The fields for entering company information in the OZG-RE will be locked. It will only be possible to synchronise and update the company information in one direction: from “Mein Unternehmenskonto” to the OZG-RE – not vice versa.

How do I delete an OZG-RE account?

First, sign directly into the OZG-RE, then select “Manage company account” from the dropdown menu at the top left of the screen. You will then have the option to delete your company account, but only if you have administrator rights. Please note that deleting a company account will also delete all the user accounts connected to it. To delete the account, click on “Delete company account”, then confirm by clicking “Delete”.

If you have signed into the OZG-RE via “Mein Unternehmenskonto”, it will not be possible to delete your OZG-RE company account here. Instead, you must delete it via the “Mein Unternehmenskonto” user account.

Whom can I contact if I have questions about using the OZG-RE or if I have issues?

A support service is available to answer your questions about using the OZG-RE or if you are having issues.

It can be reached by email or by telephone:

Support and service for invoice recipients (authorised users):

(Mon.-Fri. 08:00 AM – 04:00 PM)

Support und service for invoice senders:

(Mon.-Fri. 08:00 AM – 04:00 PM)

Is there a test IBAN that I can use in the test environment?

Where do I find information about new features and updates?

Information about new features and updates are published through the usual channels, e.g. the e-rechnung-bund.de website and newsletter for authorities of the federal administration. If you wish to receive the e-invoicing newsletter, please contact us at e-rechnung@bescha.bund.de.

Do you have any questions?

If you need further information, you can contact us directly using the contact form. In our media library you will also find video tutorials on how to use the OZG-RE.