Important information: Please note that the federal invoice submission portals, ZRE and OZG-RE, will be consolidated by summer 2025. Following the consolidation, only the OZG-RE will be operated as the sole federal invoice submission portal. The operation of the ZRE will be discontinued as of 31 December 2025. Suppliers will receive all relevant information and the required details for future invoicing directly from the authorities to which they submit invoices. For further details, please refer to this article.

XRechnung

What formats are available for creating e-invoices and how do they differ?

E-invoices must be created using a data format that meets the requirements of

- the European standard (EN 16931),

- the terms of use for the relevant invoice submission portal,

- and the requirements of the federal E-Invoicing Ordinance (E-Rechnungsverordnung, E-RechV).

In general, invoices for the federal administration must be issued using the currently valid XRechnung standard. Other invoice formats may be used (such as ZUGFeRD version 2.2.0 in the XRECHNUNG profile, as a simple structured XML file) as long as they meet the above-mentioned requirements.

Which standard should be used for invoicing the federal government?

The current version of the XRechnung standard must always be used when issuing electronic invoices to the federal administration. Any other standard can also be used, if it meets the requirements of the European standard for electronic invoicing (EN 16931), the Federal Government’s Regulation on Electronic Invoicing (E-RechV) and the Federal Government’s terms of use for the invoice submission platforms.

The ZUGFeRD 2.2.0 profile ‘XRechnung’ generally meets the requirements and enables submission of invoices via the federal government’s platforms.

What does the term 'XRechnung' stand for?

XRechnung is the standard for electronic invoicing for public contracting authorities and definitively implements Directive 2014/55/EU in Germany. The Coordination Office for IT Standards (Koordinierungsstelle für IT-Standards, in short: KoSIT) maintains and develops the XRechnung standard on behalf of the IT Planning Council. Furthermore, KoSIT coordinates the continuous development of XRechnung with assistance by experts from the federal government, the states and the municipalities.

Further information can be found on the KoSIT website.

The current version of the XRechnung standard must always be used when issuing electronic invoices to the federal administration. Any other standard (e.g. ZUGFeRD 2.2.0 with the ‘XRechnung’ profile as a purely structured XML file) can also be used, if it meets the requirements of the European standard for electronic invoicing (EN 16931), the Federal Government’s Regulation on Electronic Invoicing (E-RechV) and the federal government’s terms of use for the invoice submission platforms.

What does the XRechnung invoice standard regulate?

EU Directive EN 16931 mandates the use of the structured data format XML for electronic invoice exchange, which enables automated invoice processing. A standardised semantic data model describes the information elements of an invoice and their mutual relationship and data types (e.g. the buyer’s name). The specification of the syntax (UBL and UN/CEFACT) ensures uniform technical implementation of e-invoicing within the EU.

As a national implementation of the data model, the XRechnung invoice standard in Germany supplements the EU standard with 21 specific national business rules to be applied to individual information elements and relationships between information elements. Thus, the standard takes into account the national requirements for invoicing – such as the E-RechV. It is illustrated by the example of the information element ‘buyer reference’ in the field ‘BT-10’:

- The ‘buyer reference’ (BT-10) is an optional content element according to the EU standard

- The ‘buyer reference’ (BT-10) is a mandatory information element according to German law. The XRechnung standard thus defines the ‘buyer reference’ as a mandatory content element in which the so-called buyer reference must be indicated.

The XRechnung standard is frequently reviewed and updated. Changes will be announced 6 months before enforcement. The currently valid version of the complete documentation of the standard is available on the KoSIT website.

What is the difference between XRechnung invoicing and e‑invoicing?

An electronic invoice (e-invoice) is an invoice issued in a structured format in compliance with the EU standard, which is submitted and received electronically and enables seamless automatic and electronic processing.

- Designed as a purely semantic data format, e-invoicing enables invoice data to be imported into the processing systems directly and seamlessly.

- It is based on a structured XML format, which primarily only facilitates machine readability.

- By using display programs (so-called visualisation programs), the XML data set can be displayed in a way that is readable for humans.

There are various standards or specifications that enable electronic invoicing, e.g. XRechnung standard.

- The XRechnung standard represents a national version of European standard EN 16931, a so-called Core Invoice Usage Specification (CIUS).

- To ensure that every Member State can implement the European standard EN 16931 with its own country-specific requirements, each country defines its own specific CIUS.

- In Germany, the national version of the standard is called XRechnung. It is used for the standardised implementation of the requirements of public contracting authorities within the federal government in the majority of states and local authorities.

How can the XRechnung standard be implemented?

Depending on how outgoing invoices have been implemented so far, there are different implementation possibilities:

Do you use a service provider or commercially available software for invoicing? Contact the manufacturer and find out whether electronic invoicing is supported.

Do you use your own system? Clarify with your IT department which steps are necessary to create e-invoices in compliance with EU standard 16931 and the German legal situation. The currently valid version of the complete documentation of the standard is available on the KoSIT website.

If you are not using an outgoing invoice system or if you need an interim solution, familiarise yourself with the ZRE/OZG-RE web-based entry system.

How can an XRechnung data set be viewed?

The XRechnung XML data set must be viewed by the invoice recipient for further processing. Usually, the data set is viewed within the (ERP) system. KoSIT also offers a corresponding viewing component. The components to support viewing within a system are publicly available in the XRechnung GitHub.

If the invoice cannot be processed in a system-supported and automated way, the use of a viewing solution is recommended in order to better ‘detect’ potential errors.

Invoice issuers/senders also need to be able to view the original invoice – the XML data set – to complete accounting processes. The functionality can be integrated in the electronic outgoing invoice system or ensured via a dedicated viewing solution.

What does CIUS mean in the context of XRechnung invoicing?

The XRechnung standard represents a national version of European standard EN 16931, a so-called Core Invoice Usage Specification (CIUS). The national design of the directive in the other EU Member States specifies it with local regulations within the framework stipulated by the standard.

What is KoSIT?

KoSIT is short for “Koordinierungsstelle für IT-Standards”, the Coordination Office for IT Standards. KoSIT is responsible for maintaining the XRechnung standard and the XRechnung extension on behalf of the IT Planning Council. XRechnung is an XML-based standard consisting of various components to facilitate technical implementation. The standard has been developed by federal, state and local government experts in a joint e-invoicing project. By decision of the IT Planning Council of 22 June 2017, XRechnung is the standard format to implement Directive 2014/55/EU in Germany, making it a reliable basis for exchanging electronic invoices with Germany’s administrations. Click here to visit the official website of KoSIT (German only).

Who maintains the XRechnung standard?

The XML-based XRechnung standard and XRechnung extension are maintained by KoSIT, the Coordination Office for IT Standards*, on behalf of the IT Planning Council. XRechnung consists of various components to facilitate technical implementation. The standard has been developed by federal, state and local government experts in a joint e-invoicing project. By decision of the IT Planning Council of 22 June 2017, XRechnung is the standard format to implement Directive 2014/55/EU in Germany, making it a reliable basis for exchanging electronic invoices with Germany’s administrations.

*The IT Planning Council is the central body for IT cooperation across all administrative levels

ZUGFeRD

What is a ZUGFeRD invoice? What does ZUGFeRD stand for?

ZUGFeRD is a cross-industry data format for e-invoicing that was developed by the German electronic invoicing forum (Forum elektronische Rechnung Deutschland, FeRD) with the support of the Federal Ministry for Economic Affairs and Energy. The ZUGFeRD format is based on Directive 2014/55/EU of 16 April 2014 on electronic invoicing in public procurement, and on European standard EN 16931, published on 28 June 2017. In addition, the UN/CEFACT Cross Industry Invoice (CII) and ISO standard 19005-3:2012 (PDF/A-3) are taken into account for ZUGFeRD version 2.2.0 or later.

A hybrid data format, ZUGFeRD integrates structured invoice data in XML format into a PDF document (PDF/A-3). In other words, the invoice is sent in the form of a PDF document, which is the visual component of the invoice. In addition, a copy of the same invoice (in XML format), identical in content, is sent within the PDF so that the invoice can easily be processed electronically, using structured invoice data, once it has been fed into the company’s own software system.

For further information on ZUGFeRD, please visit the FeRD website.

Is the XRechnung standard obsolete following the release of ZUGFeRD 2.2.0?

No.

Operators who are already using ZUGFeRD can submit e-invoices to the federal administration using the 2.2.0 XRECHNUNG profile. They do not have to use the XRechnung standard in addition to that.

When using ZUGfeRD in the XRECHNUNG profile, please note that invoices are accepted only as a structured XML file with no visual format.

The ZUGFeRD 2.2.0 XRECHNUNG profile meets all requirements and allows invoices to be submitted via the federal invoice submission portals.

Invoice issuers can thus use the XRechnung standard or the ZUGFeRD invoice format to submit e-invoices in accordance with the federal E-Invoicing Ordinance.

Can I choose whether to submit my e‑invoices in XRechnung standard or in ZUGFeRD format?

Yes.

In general, invoices for the federal administration must be issued using the currently valid XRechnung standard. Other standards may be used (such as ZUGFeRD version 2.2.0 in the XRECHNUNG profile, as a simple structured XML file) as long as they meet the requirements of the European standard (EN 16931), the terms of use for the invoice submission portals, and the requirements of the federal E-Invoicing Ordinance.

XRechnung extension

What is the XRechnung extension?

In order to cover sector-specific areas of application, EU member states can expand the semantic data model of European standard EN 16931 using extensions. This has been possible in Germany since 1 January 2021. The XRechnung extension makes it possible to add several sub invoice lines below a single invoice line. The extension also allows XML files to be embedded in the invoice as attachments.

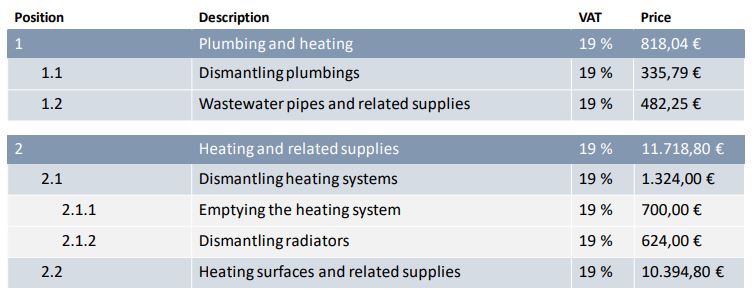

What is meant by "sub invoice lines"?

Illustration: Example of hierarchical structure of invoice lines

To include sub invoice lines, you must use the XRechnung extension. The extension has been valid since 1 January 2021 as version 2.0.0 of the XRechnung specification. For more information about the XRechnung extension, please see the website of the Coordination Office for IT Standards (KoSIT).

For whom is the XRechnung extension relevant?

The XRechnung extension is especially relevant for the construction industry, but other industries can benefit from it as well.

Although the XRechnung standard already makes it possible to submit invoice types which are specific to the construction industry (interim invoices, partial invoices, final invoices), the XRechnung extension covers additional industry-specific requirements. For example, the XRechnung extension makes it possible to embed XML attachments and thus add GAEB files[1] to your invoice as supporting documents. In addition, invoice lines can be structured so that the sub invoice lines can be used to show specifications.

[1] GAEB files are based on a uniform standard agreed on for exchanging information in the construction industry. This standard expands, harmonises and improves all the requirements for electronic processes with regard to construction work (https://www.gaeb.de/en/).

How can I create an XRechnung extension?

The ZRE and OZG-RE invoice submission platforms have accepted the current standard and the XRechnung extension since 1 January 2021, so if the XRechnung extension is relevant for you, it is possible to use it on those platforms. However, before using the XRechnung extension, the invoice issuer and the invoice recipient should communicate with each other to avoid any difficulties with formats to be used.

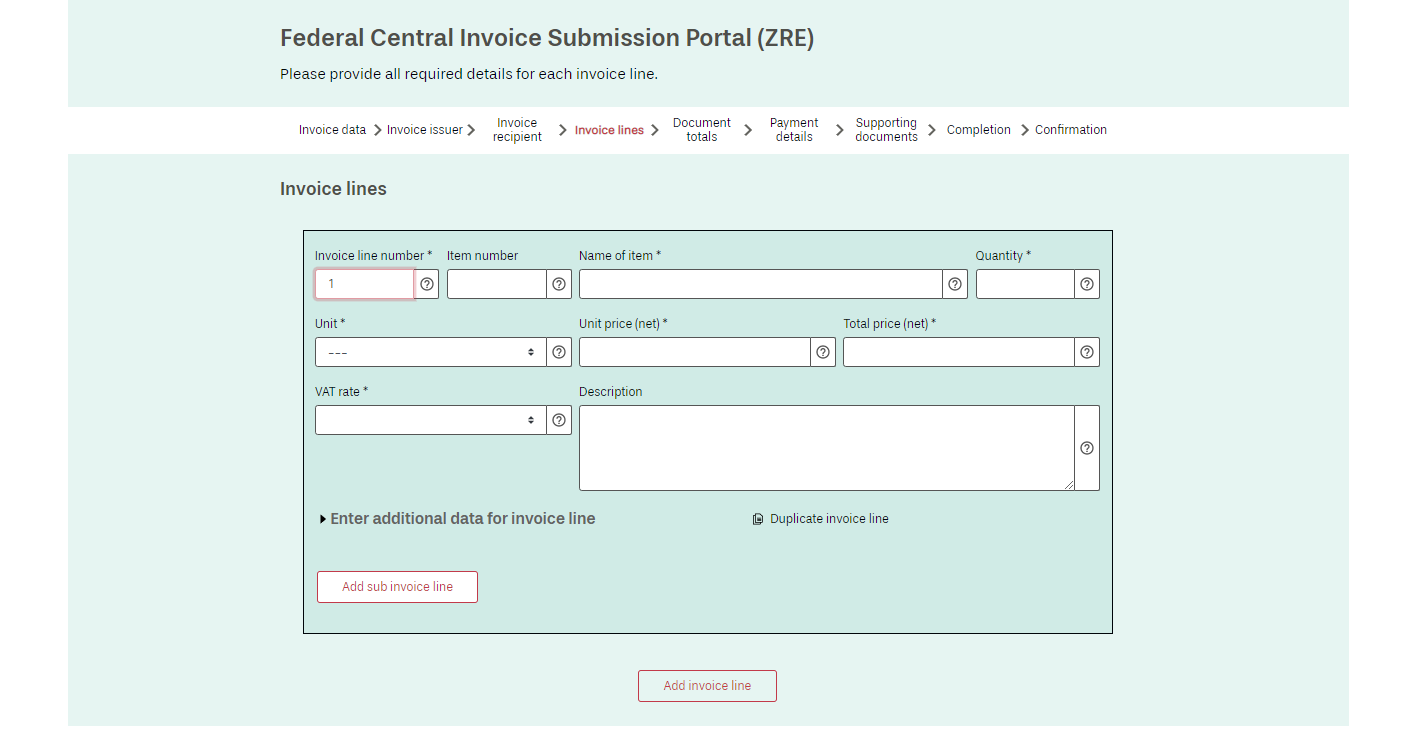

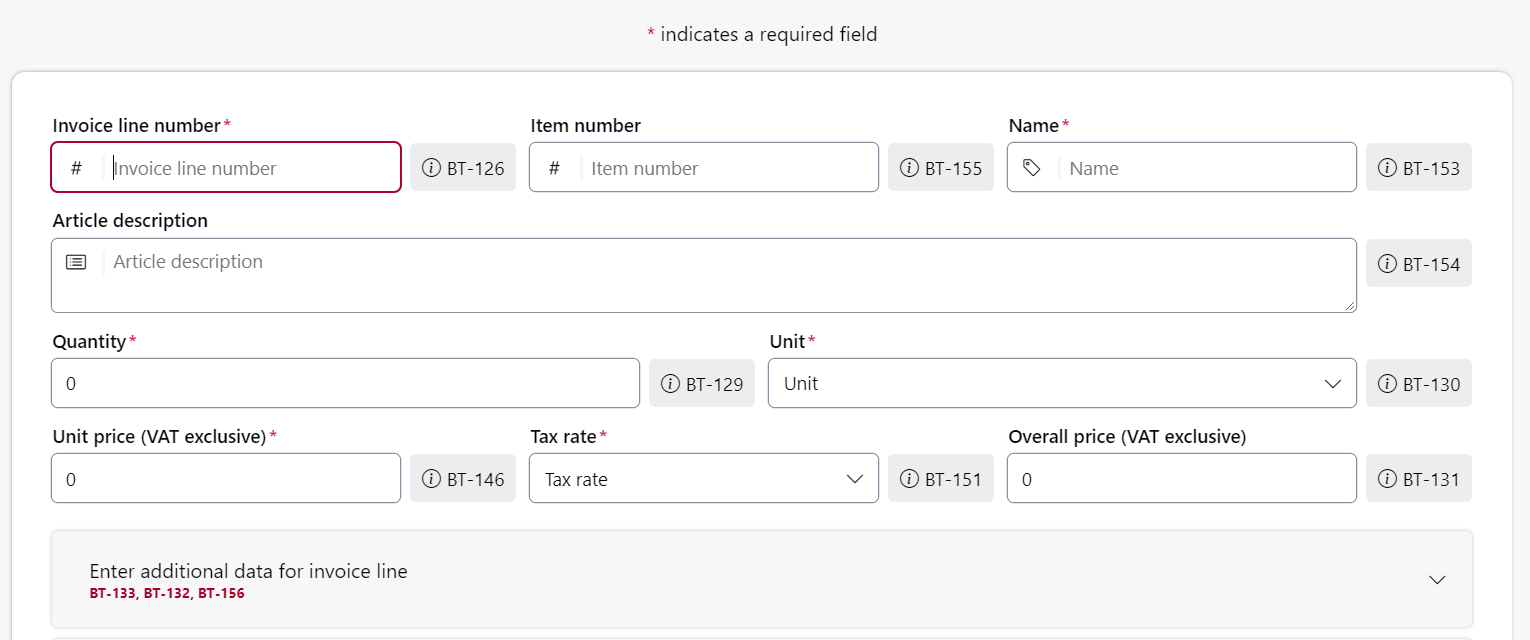

If you create invoices using the web submission form on the invoice submission platforms, under the tab “Invoice lines” you can select the button “Add sub invoice line” to add more sub invoice lines, as shown in figures 2 and 3 below. Under the tab “Attachments” you can embed XML files in the invoice as supporting documents. In this way, you can create an XRechnung extension.

Illustration: Adding invoice lines and sub invoice lines in the ZRE web submission process

Illustration: Adding invoice lines and sub invoice lines in the OZG-RE web submission process

If you submit invoices using the web upload function on the invoice submission platforms, you can submit completed e-invoices compliant with the XRechnung extension using the upload function. If you have further questions about creating e-invoices, please contact your software provider.

If you submit invoices using email or Peppol, you can submit completed e-invoices compliant with the XRechnung extension using those transmission methods as well. If you have further questions about creating e-invoices, please contact your software provider.