Important information: Please note that the federal invoice submission portals, ZRE and OZG-RE, will be consolidated by summer 2025. Following the consolidation, only the OZG-RE will be operated as the sole federal invoice submission portal. The operation of the ZRE will be discontinued as of 31 December 2025. Suppliers will receive all relevant information and the required details for future invoicing directly from the authorities to which they submit invoices. For further details, please refer to this article.

General information

What does ZRE mean?

ZRE is the German abbreviation for Zentrale Rechnungseingangsplattform des Bundes (Central Invoice Submission Portal). It is a web application allowing suppliers and service providers to send e-invoices to the respective federal administration.

The ZRE can be reached at xrechnung.bund.de.

What tasks does the ZRE take over when transmitting e-invoices?

To transmit an e-invoice to the authorities of the direct federal administration, the invoice receipt platform ZRE must be used. The ZRE platform assumes the following three tasks for the transmission of e-invoices:

- The receipt of e-invoices via various transmission channels.

- The technical verification of e-invoices (including invoice size, number and type of attachments, virus check, entry of all mandatory information)

- The transmission of e-invoices to the respective invoice recipient via buyer reference.

How can an e-invoice be viewed?

Designed as a pure data format, e-invoicing enables invoice data to be imported into the processing systems directly and seamlessly. The structured XML data record thus primarily serves for machine readability. By using display programs, the XML data set can be displayed in a way that is readable for humans.

Is there an overview of all ZRE invoice recipients?

Direct federal administration institutions and federal government constitutional bodies are connected to the ZRE. See the following page (in German only) for an overview of the public contracting authorities connected to the ZRE:

Can invoices be downloaded in XML or PDF format?

You can download e-invoices created via the web browser in XML format. The invoice in XML format is considered a valid original invoice. Invoices cannot be downloaded in PDF format.

Registration to use the ZRE

Is registration required to use the ZRE platform for invoice issuers?

The process of issuing invoices to direct federal authorities is fundamentally simplified for the invoice issuer by using the Central Invoice Submission Portal ZRE. After registering once to create a user account, invoices can be transmitted via the platform to all institutions of the direct federal administration; bilateral agreements are not necessary, as is the case with EDI procedures, for example. Registration is permitted for natural persons with full legal capacity as well as for legal entities.

Do invoice issuers have to pay for registration or use of the ZRE?

Registration and use of the ZRE platform are free of charge for invoice issuers/providers.

Please note that costs may be incurred by the user while using the ZRE platform, in particular for the provision, connection and operation of necessary software and hardware as well as for Internet use, which will not be reimbursed by the responsible parties (publisher and technical service provider) of the ZRE.

What data is required for registration with the ZRE?

The following data is required for registration with the ZRE:

• user name

• first and last name

• email contact

• password

What happens to invoices on the ZRE if the invoice issuer is not registered?

The following applies to Peppol: Invoices from non-registered invoice issuers are validated and are accordingly provided to the invoice recipient or discarded.

The following applies to all other transmission channels (i.e. email): Invoices from non-registered and registered invoice issuers without activation of the selected transmission channel are discarded by the ZRE without further verification and feedback.

What should I do if I haven't received an activation link after registering with the ZRE?

If you haven’t received an activation link, first check the spam folder of your email account. If there is no activation link there, please contact the service desk of the Federal Information Technology Centre (ITZBund) at servicedesk@itzbund.de and request a new link.

What should I do if my activation link has expired?

If your activation link has expired, please click on the expired activation link in your email. You will be redirected automatically to a web page where you can request a new activation link.

What should I do if I cannot request a new activation link?

If you are unable to request a new activation link from the web page, please contact the service desk of the Federal Information Technology Centre at servicedesk@itzbund.de to request a new link.

Submitting e‑invoices via the ZRE

How does an e-invoice reach the correct invoice recipient via the ZRE?

To ensure that an e-invoice can be forwarded by the ZRE to the addressed invoice recipient, it is mandatory for the invoice issuer to provide a so-called buyer reference to uniquely identify the invoice recipient.

Can a previously submitted e-invoice be recalled?

No. Invoices submitted via the ZRE cannot be recalled.

Users can track the current status of their invoice in the log view. If you have submitted an incorrect invoice by mistake, please contact the invoice recipient.

How can I submit supporting documents and attachments with an e-invoice to the ZRE?

To submit supporting documents or attachments with your invoice, they must be embedded in the invoice data file and should not be sent separately as an email attachment. Documents of the following file types may be embedded: PDF documents (PDF), image files (PNG, JPEG, JPG), Excel spreadsheets (XLSX), Support and OpenDocument spreadsheets (ODS), text files (CSV), and XML files when using the extension.

You have various options for embedding documents depending on the way you create your invoices and which transmission method you use to submit them to the Central Invoice Submission Portal (ZRE).

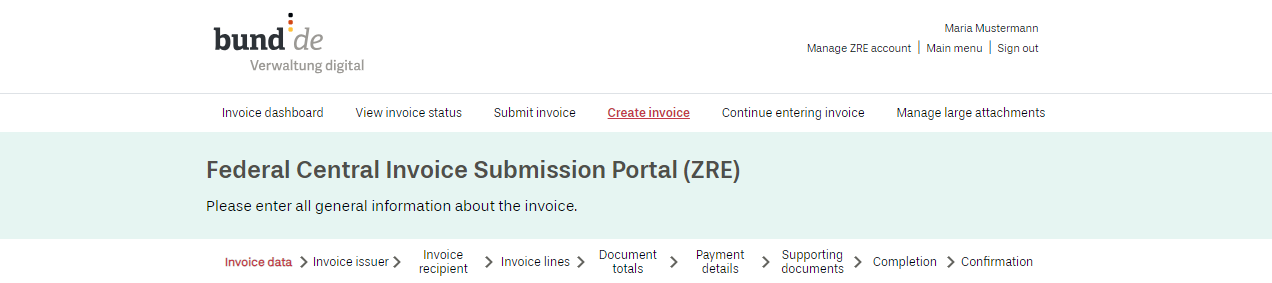

“Create invoice” (via web submission)

If you create your electronic invoice manually (see the button “Create invoice” on the dashboard), you can manually add supporting documents of the accepted file types to the invoice. In the navigation bar at the top of the screen, click on “Supporting documents”. This will open a page where you can select and upload the relevant documents from your computer, including via drag and drop. When you submit your invoice, the documents will be directly embedded in the invoice. Please note that the maximum number is limited to 200 documents and the size of all attachments is limited to 11 MB. With the 2023 winter release, an additional function was introduced which allows supporting attachments of up to 98 MB.

“Continue entering invoice”

When you use the web submission method, you can save invoice data locally and enter it later. Click on “Save draft invoice” at the bottom right of the page to save your draft invoice as a template for future invoices. You can use this template later by clicking on “Continue entering invoice” (on the dashboard) to upload it and quickly create a new invoice. You can also manually add supporting documents in the accepted file types to the invoice in this way.

“Submit invoice”

You can submit your completed invoice in the XML format using the function “Submit invoice” (on the dashboard). To attach supporting documents, you must embed them in the XML file encoded in Base64 before uploading your invoice. Please note that the maximum number is limited to 200 documents and the size of all attachments is limited to 15 MB. With the 2023 winter release, an additional function was introduced which allows supporting attachments of up to 98 MB.

For more information, contact your software provider to ask about options for embedding documents in electronic invoices.

Transmit invoice via email

You can submit your completed invoice using email. To attach supporting documents, you must embed them in the XML file encoded in Base64 before submitting your invoice. Please note that the maximum number is limited to 200 documents and the size of all attachments is limited to 10 MB. With the 2023 winter release, an additional function was introduced which allows supporting attachments of up to 98 MB.

For more information, contact your software provider to ask about options for embedding documents in electronic invoices.

Transmission via Peppol

You can submit your completed invoice using Peppol. To attach supporting documents, you must embed them in the XML file encoded in Base64 before submitting your invoice. Please note that the maximum number is limited to 200 documents and the size of all attachments is limited to 15 MB. With the 2023 winter release, an additional function was introduced which allows supporting attachments of up to 98 MB.

For more information, contact your software provider to ask about options for embedding documents in electronic invoices.

Is it possible to create invoice templates in the ZRE for recurring invoices?

Yes, an interim status (as .er file) of the manually entered invoice can be downloaded as an invoice template at any time via the function ‘Enter new invoice’ on the homepage of the ZRE.

You can upload these intermediate status files via the function ‘Continue invoice entry’ on the ZRE homepage and then continue with the invoice entry process.

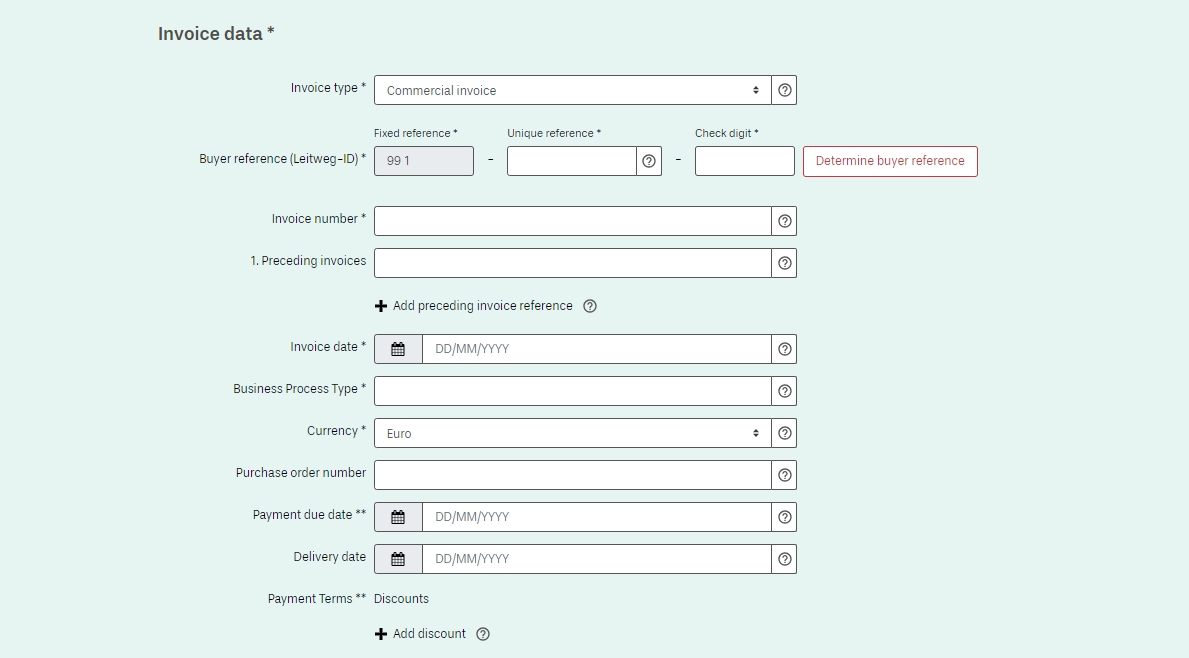

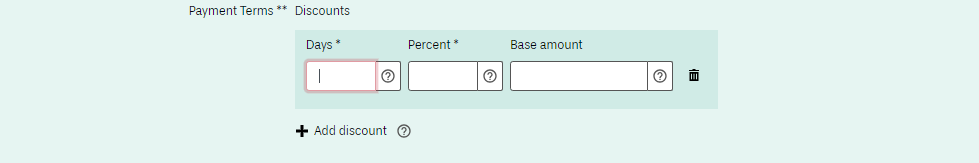

How can I include information about discounts in my electronic invoices?

When creating an electronic invoice (e-invoice), the invoice issuer has the option to give the invoice recipient a discount (reduced price) for early payment within a specified period of time.

Web submission:

If you submit e-invoices using the web submission form on the ZRE invoice submission portal, under the tab “Invoice data” you can select the button “Add discount” to add terms for discounts to your invoice.

Example: Payment is due within 30 days. For payment received within 10 days (discount period), a 2% discount is given on the invoice amount due.

Illustration: Screenshot of the ZRE user interface

Illustration: Screenshot of the ZRE user interface for entering invoice data

You can include a base amount that differs from the amount due (BT-115) if you want only part of the invoice amount to be subject to a discount. If not, simply leave the field for base amount empty. You can also add terms for one or more discounts to your invoice.

Illustration: Screenshot of the ZRE user interface for cash discount details

Upload:

Here you will find detailed instructions for including information about discounts when using the upload method for the ZRE:

![]() Download document discount upload

Download document discount upload

Email:

If you use email to transmit your invoice, your completed e-invoice (XML file) must meet the same requirements for information about discounts as described in the paragraph on using the upload method (see “Upload”).

Peppol:

If you use Peppol to transmit your invoice, your completed e-invoice (XML file) must meet the same requirements for information about discounts as described in the paragraph on using the upload transmission method (see “Upload”).

ZRE transmission methods

Which channels can invoice senders use to submit their electronic invoices to the ZRE?

When using the platforms, there are five submission channels available to invoice senders for invoices:

- Web-based data entry

- Uploading

- Web service via Peppol

For more information about the submission channels, see the ZRE technical terms of use.

How does the web entry of invoices on the ZRE work?

Web entry is particularly suitable for companies with a low volume of invoices that either do not use any outgoing invoice software or whose software does not support the creation of electronic invoices in accordance with the EU standard.

The invoice data is manually transferred by the invoice issuer to an input mask on the platform and then transmitted to the recipient. For archiving purposes, the invoice issuer is provided with the valid e-invoice in XML format for download.

Note: The platform does not provide any audit-proof archive for invoice issuers. The generated e-invoice must be archived in XML format by the supplier or invoice issuer.

Will an e-invoice submitted via the web browser be stored in my ZRE user account?

No. Invoices submitted via the web browser are not permanently stored in your ZRE user account. You can download your invoices within 30 days of submission from the “View invoice status” page. It is up to you, as the invoice issuer, to archive your invoices yourself.

In order to comply with data protection law, invoices are completely deleted from the portal 30 days after submission (see data privacy note).

Is the e-invoice submitted via web entry stored in the ZRE user account?

No. Invoices submitted via web entry cannot be subsequently accessed and downloaded. Therefore, if invoices are created via web entry, it is mandatory that the created original invoice is downloaded and archived by the invoice issuer at the end of the entry process.

How does uploading e‑invoices work on the ZRE platform?

Uploading an invoice is relevant for invoice issuers who create an electronic invoice according to the EU standard, but cannot or do not want to send it via the automatable transmission channels (email, Peppol). The option to upload an invoice manually requires registration.

How does transmission via email to the ZRE work?

In order to use the email transmission method, you will need to be able to generate valid electronic invoices using your own software.

To use this transmission method, first click on “Manage ZRE account” at the top right of the screen. This will take you to your user profile. Under “Select transmission method”, activate the “Email” option and enter the email address you wish to use for sending invoices. If you do not do this, your invoice will be rejected.

Please note the following:

- There is no need to enter a subject line in the email

- A maximum of one invoice may be sent per email as an attached XML file

- Any additional attachments will be discarded, as will any text in the body of the email

- Maximum number of documents attached to the invoice: 200

- Maximum size of e-invoice including attachments: 10 MB (attachments up to a maximum of 98 MB can be sent under “Manage large attachments” at the right of the navigation bar; large attachments must be embedded in the XML file, encoded in Base64, before sending)

- The email must be addressed to the following recipient: xrechnung@portal.bund.de

How does the transmission via the Peppol Network to the ZRE work?

As an additional transmission channel, the ZRE provides the option of sending invoices via the Peppol network. The submission of e-invoices via the Peppol network is essentially possible in three different ways:

- Use of the web service via the federal government’s existing Peppol Access Point (free)

- Use of an existing Peppol service provider (fee-based)

- Fee-based membership with OpenPeppol and the establishment of your own Peppol Access Point

In principle, no registration with the ZRE is needed to transmit electronic invoices via the Peppol network. However, the processing status of invoices submitted via the Peppol network can only be viewed if the Peppol’ transmission channel is enabled after successful registration and if the Peppol Sender ID used by the sender has been entered and verified.

Additional information you can find here.

Status of e-invoices submitted via the ZRE

How can the status of submitted e-invoices be viewed on the ZRE?

You can view the status of your submitted e-invoices in the user account, regardless of the choice of transmission channel. For this purpose, you can use the function ‘Processing status of submitted invoices’ on the ZRE homepage.

When you use the web service transmission channel via Peppol, you will also receive automatic status feedback. However, this status feedback refers exclusively to the status of the transmission and not to verification of the invoice in the ZRE.

You can find more details about Peppol here.

What should I do if payment of an e-invoice submitted to the ZRE is still outstanding?

If payment of a submitted e-invoice is still outstanding after the due date, you should first check the status of that invoice in the ZRE. You can check its status by clicking “View invoice status” on the ZRE dashboard (for more information see the FAQs on “Status of submitted e-invoices”).

We recommend that you only send an overdue payment reminder to the invoice recipient if the status of your submitted e-invoice is marked “Collected”.

If the status of your e-invoice is marked “Rejected”, please investigate possible reasons for this. There are two ways in which a submitted e-invoice can be rejected:

- Rejection by the ZRE: The submitted e-invoice is checked by the ZRE portal. If it does not meet the formal requirements for e-invoices or contains calculation errors, it is rejected by the portal.

- Rejection by the invoice recipient: In such cases, the submitted e-invoice is rejected by the recipient due to factual errors in the invoice itself. When rejecting an e-invoice, the invoice recipient should state a reason for the rejection. If no reason is stated, please check your submitted e-invoice and contact the invoice recipient if you are still unsure why it was rejected.

In both cases, the invoice must be corrected and resubmitted.

You have the option of being informed by email of any changes to the status of your e-invoices. When the status of a submitted e-invoice changes, the ZRE sends a notification to your registered email address, irrespective of the transmission method you used to send the invoice (with the exception of Peppol). Nevertheless, please always check the invoice status yourself before taking any further steps.

If you send your invoices via Peppol, you must register with the ZRE in order to view the status of submitted e-invoices in the overview of invoices. Registration and use of the ZRE are free of charge for invoice issuers.

How do I know whether the e-invoice I submitted to the ZRE has reached its intended recipient?

As an invoice issuer, you can check the status of your submitted invoices via the web interface of the ZRE. You can see the status of your submitted invoices by clicking on “View invoice status”.

You also have the option of being informed about any change to the status of your e-invoices (via email to your registered email address) if you submit your invoices by email, via web submission or by uploading them. If you do not want to use this function, you can deactivate it on the ZRE under “Manage user account”.

For further information on specific status notifications, please refer to the additional FAQs about the ZRE below.

What status notifications are issued for e-invoices submitted to the ZRE and what do they mean?

The ZRE uses the following symbols to show the status of e-invoices in the overview of invoices:

New: Your invoice has been uploaded to the ZRE, but its form has not yet been validated.

New: Your invoice has been uploaded to the ZRE, but its form has not yet been validated.- Awaiting collection: Your invoice has been validated as formally correct and is now awaiting collection by the invoice recipient.

Collected: Your invoice has been collected by the invoice recipient.

Collected: Your invoice has been collected by the invoice recipient. - Rejected: Your invoice has been rejected.

Help with using the ZRE

Is there ZRE support for invoice issuers?

A telephone and email support service is available to answer your questions about using the ZRE or if you are having issues:

(Mon. – Fri. 08:00 AM – 04:00 PM)

Are there instructions on how to use the ZRE?

Yes, the ‘User Guide for the ZRE Web Interface’ for manual creation of electronic (test) invoices for suppliers and service providers of the federal administration is available. The document shows step by step (with illustrations) how to use the ZRE web interface.

The user assistance can also be used by invoice recipients.

Is it possible to test the invoice exchange via the ZRE?

In order to avoid errors and test data accidentally being entered into the accounting books, testing must not be carried out within the productive environment. Hence, the exchange of invoices between invoice issuers and invoice recipients must be tested via a reference environment that is functionally identical to the ZRE.

Joint testing requires an agreement between the invoice issuer and the invoice recipient.

If this is not possible, invoice issuers, ERP manufacturers or service providers have the option of testing the connection to the ZRE and the validity of the submitted electronic invoices by using a test buyer reference. To use this option, please contact us via our contact form.

How can I change or reset the password in my user account for the ZRE?

It is possible to change the password via the ZRE web access. Users can manage passwords directly after logging in via the function ‘Start user administration’ and ‘Edit my user account’.

The password can be reset via the function ‘Forgot my password’ on the login page of the ZRE.

How can I delete my user account for the ZRE?

The user account can be deleted independently by the user via the web access of the ZRE by clicking on ‘Start user administration’ and ‘Edit my user account’.

The administrator is also able to delete the company account.

How can I change the email contact address in my user account for the ZRE?

A change can be made via the web access of the ZRE using the function ‘Start user administration’ and ‘Edit my user account’. The specified data in this section can be managed and changed.

Is there a test IBAN that I can use in the test environment?

Where do I find information about new features and updates?

Information about new features and updates are published through the usual channels, e.g. the e-rechnung-bund.de website and newsletter. If you wish to receive the e-invoicing newsletter for authorities of the federal administration, please contact us at e-rechnung@bescha.bund.de.

Do you have any questions?

If you need further information, you can contact us directly using the contact form. In our media library you will also find video tutorials on how to use the ZRE.