What invoice issuers need to know about e-invoicing

A quick overview

- As of 27 November 2020, you must be able to create, submit and securely store electronic invoices (e-invoices) until the required retention period has expired.

- Since that date, federal contracting authorities have no longer accepted invoices in paper form or as PDF files.

- In order to submit electronic invoices, you may have to revise your system for sending out invoices, review internal processes and train staff.

What is an electronic invoice?

Electronic invoicing allows for fully automated transmission and processing of invoice information, from the creation of invoices to their electronic transmission, automated receipt and further processing. An e-invoice presents invoice information in a structured, machine-readable data file, rather than on paper or in other data formats such as a PDF file.

What do I need to know about sending electronic invoices to federal contracting authorities?

The XRechnung standard

Technically speaking, an e-invoice is a data set arranged in a standardised structure.

In Germany, the XRechnung standard was developed to ensure uniform implementation of e-invoicing. The XRechnung standard is thus Germany’s version of the European standard EN 16931 (a Core Invoice Usage Specification, or CIUS).

The XRechnung standard enables the seamless and secure receipt of invoices and their further automated processing with various software systems. XRechnung is a standard for converting invoice information into an XML data file. The XML data file constitutes an electronic invoice. Electronic invoices for the federal administration must be issued using the current version of the XRechnung standard format in accordance with section 4 (1) sentence 1 of the federal E-Invoicing Ordinance (E-Rechnungsverordnung, ERechV). Other standards may be used (such as ZUGFeRD (version 2.2.0 or later) in the XRechnung profile) as long as they meet the requirements of the European standard (EN 16931), the terms of use for the invoice submission portals, and the requirements of the federal E-Invoicing Ordinance.

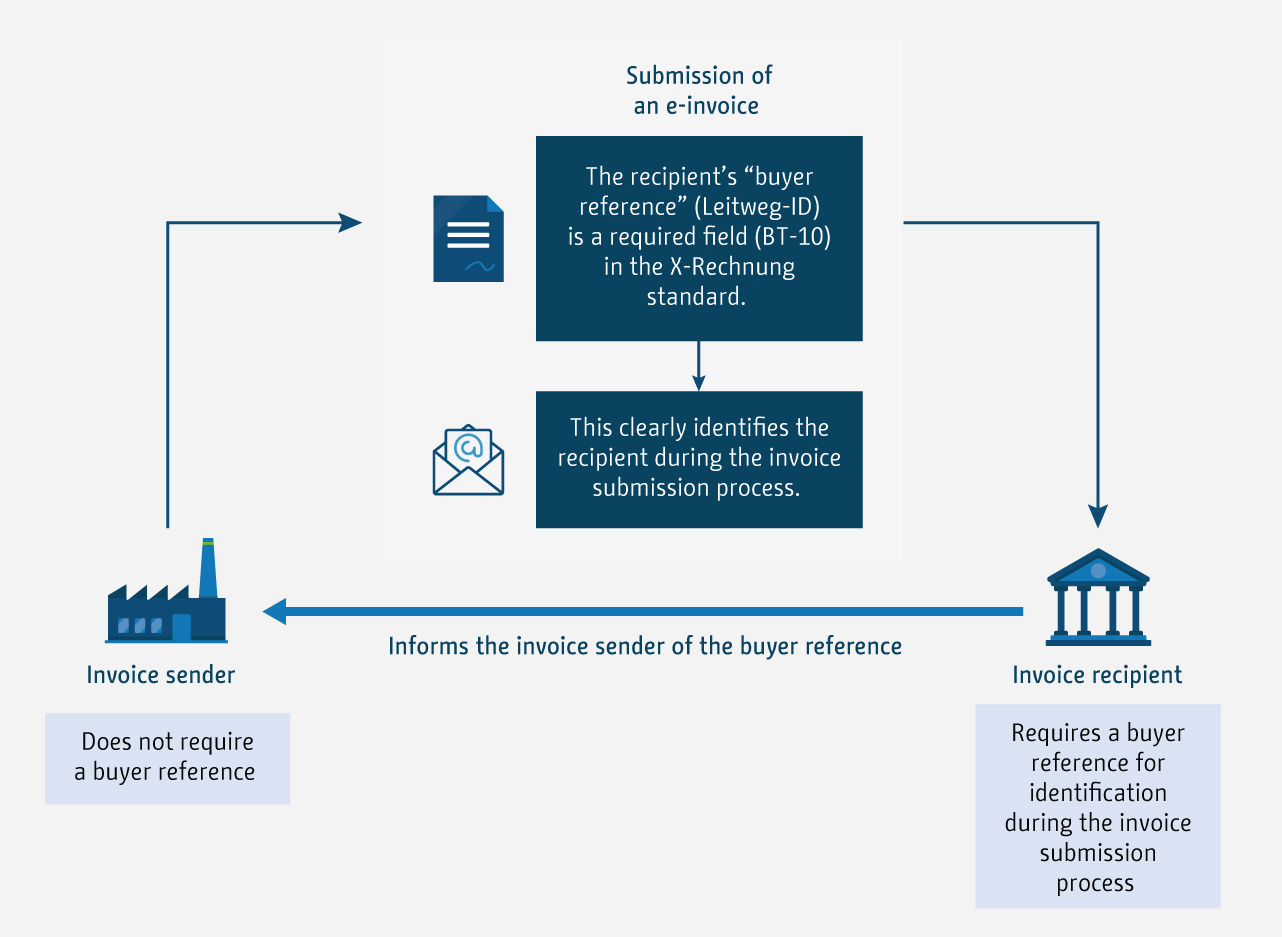

Buyer reference (Leitweg-ID)

The invoice recipient’s buyer reference is entered in the field “Buyer reference” (BT-10) in the XRechnung standard. The buyer reference must be provided with every e-invoice sent to federal administration authorities. The contracting authority should provide the invoice issuer with its buyer reference; if not, the invoice issuer should ask the contracting authority for it.

Illustration: Transmission of an e-invoice using the buyer reference (Leitweg-ID)

Please note that invoice issuers do not need a buyer reference of their own.

The federal invoice submission portals

Currently, two invoice submission portals are available at the federal level to submit e-invoices: the Central Invoice Submission Portal of the Federal Government (ZRE) and the Online Access Act-compliant Invoice Submission Portal (OZG-RE). These submission portals are scheduled to be consolidated by summer 2025. Following the consolidation, only the OZG-RE will be operated as the sole federal invoice submission portal. The operation of the ZRE will be discontinued as of 31 December 2025. This aims to provide invoice issuers with a unified submission portal via the OZG-RE, thereby reducing effort and complexity. In addition, the OZG-RE already offers you efficient services, such as access via the Mein Unternehmenskonto (based on the ELSTER tax software).

Until the consolidation is complete, invoice issuers must ensure that the correct portal is used before submitting an e-invoice. This information is provided during the ordering process or can be obtained from the contracting authority. Further information on what the consolidation means for users of the ZRE can be found in this article.

The Federal Central Invoice Submission Portal (ZRE)

Organisations of the direct federal administration receive e-invoices via the Federal Central Invoice Submission Portal (ZRE) until their connection to the OZG-RE.

You can register with the ZRE test environment to try out the electronic invoice functions before actually sending any invoices to the federal administration.

You can register as an invoice issuer with the ZRE production environment to create and submit your invoices.

Before submitting an invoice via the ZRE, please ensure that you are using the correct invoice submission portal. Suppliers will be informed by their respective authorities in good time once the specific date for transitioning to the OZG-RE has been determined. Furthermore, invoice issuers who continue to submit invoices to the ZRE after their authority has transitioned to the OZG-RE will receive a notification from the ZRE indicating that the invoice has been rejected because the buyer reference (Leitweg-ID) has been migrated to the OZG-RE.

An overview of the authorities already connected to the OZG-RE can be found here (overview in German only).

Online Access Act-compliant Invoice Submission Portal (OZG-RE)

Many organisations of the indirect federal administration already receive e-invoices via the federal Online Access Act-compliant Invoice Submission Portal (OZG-RE).

You can register with the OZG-RE test environment to try out the electronic invoice functions before actually sending any invoices to the federal administration.

You can register as an invoice issuer with the OZG-RE production environment to create and submit your invoices.

Please note: In addition to the OZG-RE, organisations of the indirect federal administration may implement their own solutions for receiving electronic invoices. Please check with your invoice recipient.

An overview of the invoice recipients from the direct and indirect federal administration currently connected to the OZG-RE is available here (overview in German only).

Transmission methods

You can create an e-invoice manually in the ZRE and the OZG-RE, or you can create one outside the federal invoice submission portals, for example using a standard commercial enterprise resource planning (ERP) system. The federal invoice submission portals offer four different ways to send e-invoices.

Before sending an e-invoice to a federal contracting authority, you should choose the transmission method that works best for you. You can find more information in the guide to choosing a transmission method.

Web submission

To create an e-invoice, you can enter the invoice information manually within the federal invoice submission portals and submit the e-invoice from there:

- ZRE: Create invoice

- OZG-RE: Create new invoice

Manual upload

After registering with the federal invoice submission portals, you can upload e-invoices that you have created using an external system and submit them to your invoice recipient:

- ZRE: Submit invoice

- OZG-RE: Submit an invoice created externally

Peppol

Peppol enables the fully automated exchange of electronic documents. This means that all participants can seamlessly export and import documents from different processing systems. The Peppol network is especially helpful for sending large numbers of e-invoices (mass transmission), but even for smaller transmissions, the Peppol network enables seamless and efficient digital processing.

You can send e-invoices that you have created using an external system via email to the federal invoice submission portals.

- ZRE: Manage ZRE account › Select transmission method › Email

- OZG-RE: Send externally created e-invoice via email

Invoice information

According to the federal E-Invoicing Ordinance (document available in German only), an e-invoice must include at least the following information:

- Buyer reference (Leitweg-ID)

- Bank details

- Payment terms

- The email address of the invoice issuer

- Seller identifier*

- Purchase order reference*

*If this information was provided to the invoice issuer when the contract was awarded.

E-invoicing in Germany’s federal states

The federal E-Invoicing Ordinance governs the sending of e-invoices by suppliers to the federal administration. Germany’s federal states implement EU Directive 2014/55/EU under their own responsibility.

In order to help you send e-invoices to the federal states, we have put together some useful information:

Further information for invoice issuers

In the library, you will find extensive information about e-invoicing in the federal administration, videos explaining how to use the Peppol network and video tutorials on using the federal invoice submission portals ZRE and OZG-RE. If you have any questions, please let us know. Write to us using our contact form.